Notices

BURNING:

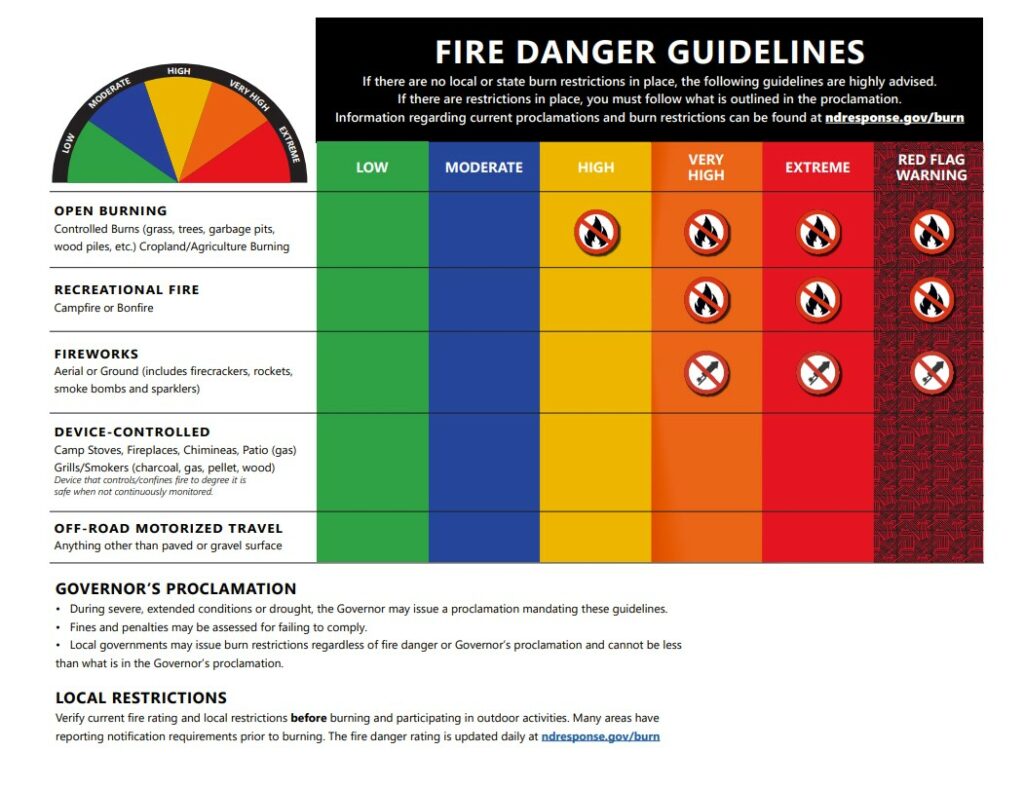

Check for restrictions by clicking here before burning and participating in outdoor activities.

It is critical that you verify current restrictions BEFORE burning or participating in outdoor activities as conditions may develop throughout the day, such as issuance of a Red Flag Warning, that results in a change in restriction status.This all-in-one map enables users to check for Burn Restrictions, Fire Danger ratings, Red Flag warnings, and local declarations within one intuitive tool.All National Forest System lands within the Little Missouri National Grassland, Denbigh Experimental Forest, and Souris Purchase Unit adopt Burn Ban restrictions in corresponding counties when the given county has: (a) implemented a burn ban/restriction; and (b) is identified as having a “Very High” or “Extreme” fire danger on the North Dakota Fire Danger Rating Map or the given county is under a Red Flag Warning.

NOTICE TO THE PUBLIC:

Contact

CONTACT

EMAIL: auditor@bowmancountynd.gov

PHONE: (701) 523-3130

Bowman County Auditor

104 1st St NW, Suite 1

Bowman ND 58623

OFFICE HOURS

Monday – Thursday:

7:30am – 12:00pm MT

12:30pm – 4:30pm MT

Friday:

7:30am – 12:00pm MT

(Closed on Legal Holidays)